Fixed Deposit Interest

Fixed Deposit Account It is an investment account with a specific amount invested at an agreed interest rate and tenor. Based on customer’s instructions, at the end of agreed period (tenor), the investment can either be rolled over (re-invested) or liquidated (returned to customer) with the interest amount earned. The interest rate for FDs is fixed at the time of opening the deposit and independent of any fluctuations in the market. Some financial institutions even allow one to break their FDs prematurely on paying a certain penalty fee. An FD calculator can be used to determine the interest and the amount that it will accrue at the time of maturity. Fixed Deposit maturity amount can be calculated using the FD Calculator in a simple manner using the below steps: Customer will have to select the Customer Type i.e. Normal or Senior Citizen; Select the type of Fixed Deposit i.e. Cumulative or Interest Payout (Quarterly/Monthly) or Short Term FD. A fixed deposit (FD) is a financial instrument provided by banks or NBFCs which provides investors a higher rate of interest than a regular savings account, until the given maturity date.It may or may not require the creation of a separate account. It is known as a term deposit or time deposit in Canada, Australia, New Zealand, India and The United States, and as a bond in the United Kingdom.

In this article, I will enlighten you on best-fixed deposit rates in Kenya. A fixed deposit is the most popular way of saving money. It is a sure investment as well as offers good returns.

Maximum – 8.50% AYA Time Deposit is ideal for the individual who has excess cash for an extended period of time. The account is opened for a particular fixed period (time) by depositing particular amount (money) and withdrawal is only allowed at the end of the particular period.

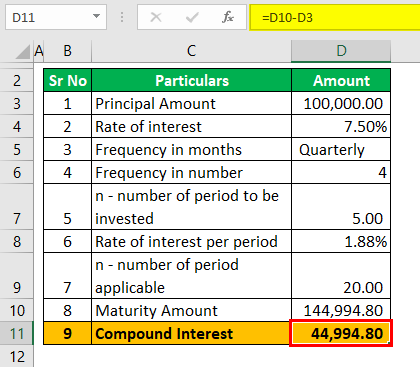

While opening a fixed deposit account, you will need to put a fixed tenure at an agreed rate of interest. At the end of this tenure, you will receive the amount you have invested plus compound interest.

With a fixed deposit account, you are guaranteed of positive returns. These returns do not fluctuate over time as opposed to market-led investments.

Even though the fixed deposit rate falls, you will continue to receive the interest decided when you opened the account.

The return on investment on fixed deposit accounts depends on the fixed deposit interest rate and the type of deposit you are investing.

You can opt for a monthly or quarterly pay-out of interest or the reinvestment option, which will give you the benefit of compounding.

While fixed deposit accounts are fixed for an agreed tenure/period, you can take out a loan against it in the form of an overdraft.

The benefit of this kind of loan is that your investment continues to earn interest and you do not have to withdraw your money prematurely.

Best Fixed Deposit Rates in Kenya

Here are the best Fixed Deposit Rates in Kenya in 2020

1. KCB Bank

KCB offers a competitive fixed deposit rate for local and foreign currencies.

The bank, however, has a condition, money must remain in the fixed deposit rate account for the agreed period.

They offer an interest rate of up to 6% p.a. on your savings

2. I&M Bank

Fixed deposit accounts in I&M Bank are opened for fixed contracted periods, which range from one month to one year.

The bank boasts of having attractive rates, thus providing customers with long term savings growth opportunities.

Fixed deposit accounts can be opened in the following currencies,

- Kenya Shillings

- US Dollars

- Euro

- GB Pounds

- South African Rand

In I&M Bank, the minimum you are allowed to deposit for your fixed deposit account is Ksh. 50,000

3. CBA Bank

CBA bank fixed deposit account offers flexible investment periods with interest that is paid upon maturity or at predetermined times of the year.

In CBA, you have the luxury of investing in both local or foreign currency.

You require the minimum of Ksh 100,000 / USD 10,000 as the deposit amount in CBA.

4. Stanbic Bank

Interest rates at Stanbic bank are fixed during the investment period and funds available on maturity.

There is no monthly fee charged to this account, and interest is also calculated upon maturity.

5. Standard Chartered Bank

The fixed deposit account is available to clients of this bank in Kenya Shillings, US Dollar, Pound Sterling, Euro, Japanese Yen, Australian Dollar and South Africa Rand.

What is attractive about this bank is that you can negotiate for a fixed deposit rate that suits you.

You can access personal loans and overdrafts equivalent to 80% of the balance in the Fixed Deposit Account.

You require a minimum of deposit of Ksh 100,000

5. Equity Bank

Equity Bank fixed deposit account provides you with a medium for investment opportunities for individual savers, businesses and organisations.

The minimum amount you can invest in this bank is Ksh 20,000 with a minimum investment period of one month.

The bank allows you to negotiate the fixed deposit interest rate that best suits you.

One of the benefits of the fixed deposit rate accounts in this bank is that you can withdraw prematurely.

It also allows direct borrowing of up to 80%.

6. Cooperative Bank

The investment period offered by Coop Bank is one to twelve months.

The clients are then paid a competitive rate for the period the money is held in the account.

7. DTB Bank

The minimum deposit allowed at this bank is Ksh 100,000, and it offers a competitive fixed deposit rate.

You can also deposit using foreign currency–> USD 10,000 or GBP 10,000

8. Consolidated Bank

This facility is available to both individuals and business clients.

You require a minimum account opening balance of Ksh 50,000.

You can invest at this bank for a period one month, 2, 3, 6, 9 or 12 months or on call.

The account holder can get a loan and overdraft using the deposit account.

More about the fixed deposit rates in Kenya

- The interest rate is fixed and guaranteed for the term of the investment, so you don`t have to worry about declining interest rates.

- Depending on what bank you settle on, interest payment options are flexible, allowing interest to be paid monthly, quarterly, half-yearly, annually or upon maturity.

- Some banks will enable you to the fixed deposit accounts as security against a loan or overdraft.

- You have the choice of changing your investment period, inform the bank before the date of maturity.

- Some banks offer a free advice slip in the mail upon maturity or on request, also enquire about this from your respective bank.

A fixed deposit (FD) is a financial instrument provided by banks or NBFCs which provides investors a higher rate of interest than a regular savings account, until the given maturity date. It may or may not require the creation of a separate account. It is known as a term deposit or time deposit in Canada, Australia, New Zealand, India and The United States, and as a bond in the United Kingdom and for a fixed deposit is that the money cannot be withdrawn from the FD as compared to a recurring deposit or a demand deposit before maturity. Some banks may offer additional services to FD holders such as loans against FD certificates at competitive interest rates. It's important to note that banks may offer lesser interest rates under uncertain economic conditions. The interest rate varies between 4 and 7.50 percent.[1] The tenure of an FD can vary from 7, 15 or 45 days to 1.5 years and can be as high as 10 years.[2] These investments are safer than Post Office Schemes as they are covered by the Deposit Insurance and Credit Guarantee Corporation (DICGC). However, DICGC guarantees amount up to ₹ 500000(about $6850) per depositor per bank.[3] They also offer income tax and wealth tax benefits.

Explanation[edit]

Fixed deposits are a high-interest-yielding term deposit and offered by banks in India. The most popular form of term deposits are fixed deposits, while other forms of term deposits are recurring deposit and Flexi Fixed deposits (the latter is actually a combination of demand deposit and fixed deposit)[citation needed].

Fixed Deposit Interest Calculator

To compensate for the low liquidity, FDs offer higher rates of interest than saving accounts.[citation needed] The longest permissible term for FDs is 10 years. Generally, the longer the term of deposit, higher is the rate of interest but a bank may offer lower rate of interest for a longer period if it expects interest rates, at which the Central Bank of a nation lends to banks ('repo rates'), will dip in the future.[4]

Usually in India the interest on FDs is paid every three months from the date of the deposit (e.g. if FD a/c was opened on 15 Feb, the first interest installment would be paid on 15 May). The interest is credited to the customers' Savings bank account or sent to them by cheque. This is a Simple FD.[5] The customer may choose to have the interest reinvested in the FD account. In this case, the deposit is called the Cumulative FD or compound interest FD. For such deposits, the interest is paid with the invested amount on maturity of the deposit at the end of the term.[6]

Fixed Deposit Interest Rates Usa

Although banks can refuse to repay FDs before the expiry of the deposit, they generally don't. This is known as a premature withdrawal. In such cases, interest is paid at the rate applicable at the time of withdrawal. For example, a deposit is made for 5 years at 8%, but is withdrawn after 2 years. If the rate applicable on the date of deposit for 2 years is 5 per cent, the interest will be paid at 5 per cent. Banks can charge a penalty for premature withdrawal.[5]

Banks issue a separate receipt for every FD because each deposit is treated as a distinct contract. This receipt is known as the Fixed Deposit Receipt (FDR), that has to be surrendered to the bank at the time of renewal or encashment.[7]

Many banks offer the facility of automatic renewal of FDs where the customers do give new instructions for the matured deposit. On the date of maturity, such deposits are renewed for a similar term as that of the original deposit at the rate prevailing on the date of renewal.

Income tax regulations require that FD maturity proceeds exceeding Rs 20,000 not to be paid in cash. Repayment of such and larger deposits has to be either by 'A/c payee' crossed cheque in the name of the customer or by credit to the saving bank a/c or current a/c of the customer.

Nowadays, banks give the facility of Flexi or sweep in FD, where in customers can withdraw their money through ATM, through cheque or through funds transfer from their FD account. In such cases, whatever interest is accrued on the amount they have withdrawn will be credited to their savings account (the account that has been linked to their FD) and the balance amount will automatically be converted in their new FD. This system helps them in getting their funds from their FD account at the times of emergency in a timely manner.

Benefits[edit]

- Customers can avail loans against FDs up to 80 to 90 percent of the value of deposits. The rate of interest on the loan could be 1 to 2 percent over the rate offered on the deposit.[8]

- Residents of India can open these accounts for a minimum of seven days.

- Investing in a fixed deposit earns customers a higher interest rate than depositing money in a saving account.

- Tax saving fixed deposits are a type of fixed deposits that allow the investor to save tax under Section 80C of the Income Tax Act. [9]

Taxability[edit]

Tax is deducted by the banks on FDs if interest paid to a customer at any bank exceeds Rs. 10,000 in a financial year. This is applicable to both interest payable or reinvested per customer. This is called Tax deducted at Source and is presently fixed at 10% of the interest. With CBS banks can tally FD holding of a customer across various branches and TDS is applied if interest exceeds Rs 10,000.Banks issue Form 16 A every quarter to the customer, as a receipt for Tax Deducted at Source.[10]

However, tax on interest from fixed deposits is not 10%; it is applicable at the rate of tax slab of the deposit holder. If any tax on Fixed Deposit interest is due after TDS, the holder is expected to declare it in Income Tax returns and pay it by himself.

If the total income for a year does not fall within the overall taxable limits, customers can submit a Form 15 G (below 60 years of age) or Form 15 H (above 60 years of age) to the bank when starting the FD and at the start of every financial year to avoid TDS.

How bank FD rates of interest vary with Central Bank policy[edit]

In certain macroeconomic conditions (particularly during periods of high inflation) a Central Bank adopts a tight monetary policy, that is, it hikes the interest rates at which it lends to banks ('repo rates'?). Under such conditions, banks also hike both their lending (i.e. loan) as well as deposit (FD) rates. Under such conditions of high FD rates, FDs become an attractive investment avenue as they offer good returns and are almost completely secure with no risk[citation needed]. These can be checked with the excess rates in the country.

See also[edit]

References[edit]

Fixed Deposit Interest Rate

- ^Sumant Khanderao Muranjan (1952). Modern banking in India. Kamala Pub. House. p. 80.

- ^Mohan Lal Tannan (1965). Banking law and practice inIndia. Thacker. p. 23.

- ^'DICGC – A guide to FD'. Archived from the original on 22 August 2013. Retrieved 6 January 2014.

3. What is the maximum deposit amount insured by the DICGC? Each depositor in a bank is insured up to a maximum of 100,000 (Rupees One Lakh) for both principal and interest amount held by him in the same right and same capacity as on the date of liquidation/cancellation of bank's licence or the date on which the scheme of amalgamation/merger/reconstruction comes into force.

- ^R. P. Maheshwari (1997). A Complete Course in ISC Commerce. Pitambar Publishing. p. 102. ISBN978-81-209-0643-3.

- ^ abRaj Kapila; Uma Kapila (May 2001). India's banking and financial sector in the new millennium. Academic Ffoundation. p. 199. ISBN978-81-7188-223-6.

- ^Ambika Prasad Dash (2009). Security Analysis And Portfolio Management (Paperback) , Second Edition. I. K. International Pvt Ltd. p. 55. ISBN978-93-8002-610-7.

- ^Muralidharan. Modern Banking: Theory And Practice. PHI Learning Pvt. Ltd. p. 274. ISBN978-81-203-3655-1.

- ^Nico Swart (2004). Personal Financial 'Learn to earn money' Management. Juta and Company Ltd. p. 338. ISBN978-0-7021-5514-7.

- ^'Benefits of Investing in Tax Saving Fixed Deposits'.

- ^Outlook Publishing (22 May 2008). Outlook Money. Outlook Publishing. p. 27.