Santander Pay In Cheque App Uk

Santander Consumer USA Inc., its subsidiaries or affiliates are not responsible for the transaction, the outcome of the transaction or any information provided therein, provided that if Santander Consumer is chosen as the lender to finance the vehicle purchase, the financing will be performed by Santander. If you pay in a cheque on a weekday (before our cut-off time) you can withdraw the funds by 23:59 on the next weekday (as long as the cheque hasn’t bounced). Introducing mobile cheque deposit You can now pay in cheques by taking a picture using the HSBC UK Mobile Banking app.

I’ll explain what Santander charges for an International Transfer, how long it takes, and how to make a Santander International Payment.

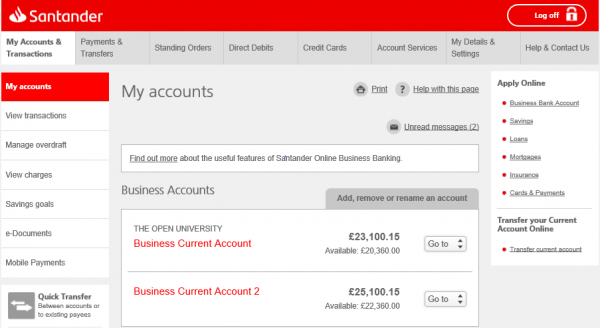

Manage your company’s money online with Santander internet banking; view important account information and related services. Find out more at santander.co.uk.

Hopefully, it will save you time reading pages of bank jargon and complicated fee schedules.

Santander international payment charges explained

There are two charges you need to be aware of with a Santander international payment:

- Transfer fees

- Exchange rates

While the transfer fee is the more obvious, it is often the smaller charge.

A lot of people mistakenly think the transfer fee is the only charge.

But the exchange rate has a mark-up or profit margin added to it.

This is not visible, so it is often overlooked.

I’ll explain in more detail below.

Santander international transfer fee

An international transfer fee is just a simple, flat fee charged per transfer.

It doesn’t matter how big or small your transfer; the fee is the same.

Santander charges a £25 fee to make an International Payment.

The terminology used by Santander is an “electronic transfer”.

You will be charged £25 for an electronic transfer whether you use Online Banking, Telephone Banking or visit a Branch.

Santander International Payments | Online | Branch or Telephone | One Pay FX (mobile) |

Transfer Fee | £25 | £25 | Free |

The One Pay FX mobile app was launched by Santander in 2018.

It’s a mobile app that is targeted towards smaller payments to friends and family.

One Pay FX has a £10,000 limit and can only make payments in Euros, US Dollars and Polish Zloty.

While the £25 transfer fee charged by Santander is not massive, it is annoying and can add up if you make frequent payments.

Some of the other big UK banks charge a lower fee if you do your transfer online.

If you want to avoid paying transfer fees, you can use a money transfer specialist such as ourselves.

We don’t charge any transfer fees.

Santander exchange rates

You can easily find exchange rates online these days.

Google will give you a rate.

And websites like XE, Oanda and Daily FX are popular for live rates, charts and news.

But here’s the catch…the rates you see online are basically wholesale rates which are not available to customers.

It’s a little-known fact.

There is usually a disclaimer hidden away somewhere that will disclose this.

A bank, such as Santander, formulates its own exchange rates by adding a 'margin' to its wholesale rates.

The exchange rate margin added by Santander is very dependent on the size of your international transfer.

Put simply, the bigger the transfer, the better the exchange rate.

There is not a single, standard rate charged by Santander.

All the banks, including Santander, use a sliding scale.

More money, tighter margin.

Unless you are looking to transfer a really large amount (over £100,000), you can expect a margin of between 2%-4%.

It very much depends on the currencies involved and the exact amount of your transfer.

The point is if you just accept the rate charged by your bank, you could end up paying a lot more than you wanted, or your recipient could receive a lot less than they expected.

Small differences in the exchange rate can have a big financial impact.

As a quick example, say you were transferring £70,000 to Spain to buy a holiday house.

If the rate at Santander was just 1% higher, it would cost you an extra £700 in exchange rate costs.

You can see that small increments can easily escalate your costs.

The simplest thing to do is get a quote from an alternative provider and compare how much money you would receive.

Trying another bank isn’t normally a viable alternative.

The big banks require you to have a bank account with them already – which involves a fair bit of time and hassle to set up.

A money transfer specialist is the easiest way for you to benchmark your bank and find out the potential savings.

Once you know what you can save, you can then make an informed decision.

As a quick tip, if you want to carry out a cost comparison, you should do it at roughly the same time as the rate will be moving around throughout the day.

3 types of Santander international transfers

Santander offers three types of International Payments, but fear not, only one of the options is applicable to most people.

An “Electronic Transfer” is the type most people are looking for when sending money abroad.

An electronic transfer with Satnader has a £25 charge.

Santander also offers an “Electronic Euro Transfer (or SEPA transfer)”.

But it's not applicable for most Brits.

A SEPA transfer is used if you’re sending Euros to Euros – meaning there’s no currency conversion. For example, someone sending Euros from Spain to France.

The third type of International Payment is a “Currency Draft (Cheque)”.

A draft might be a bit old fashioned, but it is sometimes required for settling financial transactions with a third party.

It is a slower way of sending money abroad because it involves the sender physically posting the draft to the recipient, who then needs to physically bank it.

How to make a Santander international payment

The first step is to choose how you want to send your money:

Santander Pay In Cheque App Uku

- Online Banking

- One Pay FX app

- Telephone Banking; or

- Branch

Here's a quick overview of each...

For Online Banking, you log in as normal.

Within the Payments & Transfers, select International Payments.

It’s fairly intuitive from here.

You will need to enter the amount of Pounds and the currency you need.

The system will quote you a rate.

You will also need the IBAN of the recipient.

Once everything is entered and confirmed by you, Santander will ping you a One Time Passcode to your mobile for security purposes.

For the One Pay FX app, here is a 1-minute instructional video you can watch.

Don’t forget this app is limited to £10,000 max and only three currencies (EUR, USD, PLN).

For Telephone Banking you call 0800 9 123 123.

For Branch, it will involve filling out forms. Hopefully, you will get someone who knows what they’re doing.

The 2 bits of information you will need

To send a Santander international payment, you need the following:

- Recipients full name (can be you or someone else)

- The Account Number and their banks BIC

Alternatively, you can use the IBAN (international bank account number) for the recipient bank account.

The IBAN includes the country code, bank code, branch code and account number – that’s why it’s so damn long.

The easiest way to find the IBAN is to look at a bank statement.

If that’s not possible, you can go into a branch and ask.

You can also try and cobble it together yourself using a free online tool like this.

There are quite a few free online IBAN generators, so I’m not promoting any particular one.

One option might be to use a money transfer specialist. They can assist you with all the payment details and help make sure everything is correct.

How long does a Santander international transfer take?

It depends on the currency.

Santander says to allow up to 4 working days. It should be a bit quicker for EUR and USD transfers.

Can You Pay In A Cheque On Santander App Uk

While different time zones, weekends and daily cut-off times can cause delays, the time taken is often a result of the recipient foreign bank.

The recipient bank will do its own checks before they clear the money into your account.

That part is outside the control of Santander.

A trusted and helpful alternative: Key Currency

You don’t have to use Santander to make an international payment, even if they have your money.

The main alternative is to use a money transfer specialist.

Why?

A money transfer specialist, such as Key Currency may be cheaper and more efficient.

We have far lower overheads than a big bank like Santander, so we can pass on the savings to our customers.

You won’t pay any transfer fees, and our exchange rates are very competitive and responsive to the market.

Another consideration is that we specialise in money transfers.

It’s what we do day-in, day-out.

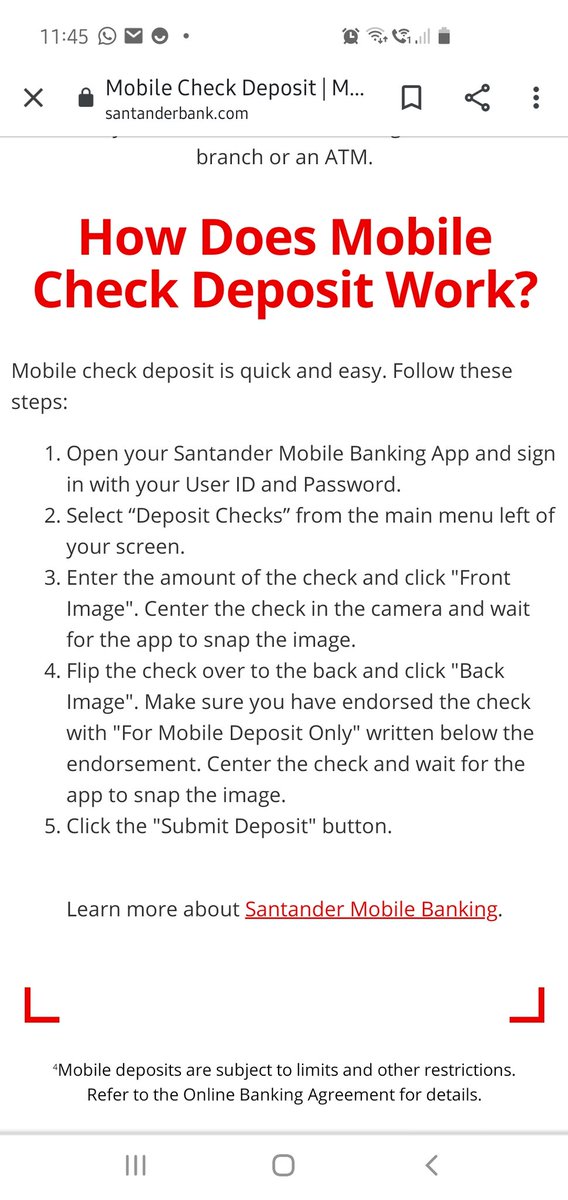

How To Pay In A Cheque Santander Mobile App

As a customer, you are provided with an account manager who will look after your transfer from start to finish.

It takes the stress away.

There are some common pitfalls when customers go online and try and do everything themselves.

They can make a mistake on the payment details, sending their money into the abyss.

Or they chose a terrible time to exchange their money, which costs them a bundle from getting a poor exchange rate.

At Key Currency, we provide a genuinely helpful service.

Our company has attained a 5-star 'Excellent' customer rating on Trustpilot based on hundreds of reviews.

We assist you with the transfer details, discuss and agree with you on the right time to exchange your money and then keep you informed throughout the process.

We don't push you onto a trading platform or make you download an app.

You also have the peace of mind knowing that Key Currency is an FCA regulated Authorised Payment Institution (No. 753989), and as such, all money transfers are conducted through safeguarded client accounts.

If you would like to compare our rates to Santander, simply request a free quote below.