Me Bank Term Deposit

| Type | Private |

|---|---|

| Industry | Banking |

| Predecessor | Super Member Home Loans (SMHL) |

| Founded | 1994; 27 years ago |

| Headquarters | , Australia |

| Australia wide | |

Key people | |

| Total assets | A$27.300 billion |

Number of employees | 1800 |

| Parent | 26 industry super funds |

| Website | www.mebank.com.au |

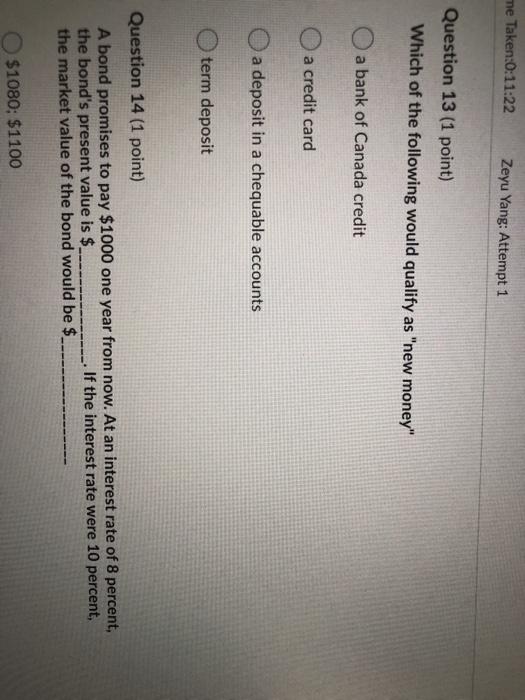

- Me Bank Term Deposit Rates

- Bank Term Deposit Interest Rates

- Australian Bank Term Deposit Rates

- Me Bank Term Deposits

ME Bank, also known as ME, is an Australian direct bank based in Melbourne, Victoria. ME Bank also has offices in Sydney, Brisbane, Adelaide, Perth, Hobart, Canberra and Darwin.

Me Bank Term Deposit Rates

Founded in 1994 as Super Member Home Loans (SMHL) by Australia's industry superannuation funds, SMHL became Members Equity Bank in 1999, and received a banking licence from the Australian Prudential Regulatory Authority (APRA) in July 2001 and was approved by APRA to act as an authorised deposit-taking institution, authorised to accept deposits from the public.

Initially founded to offer access to home loan products, ME Bank today offers a range of low-cost banking products including home loans, savings accounts, credit cards, term deposits, and transaction accounts.

ME bank was the king of the crop including majors for the best deposit rates, and Customer Service. On line access and info available was OK at best. Then came the closure of branches so much that in the ACT you have to travel to the city centre to access an only branch. Our term deposit offer high interest rates for fixed periods of time to reach your savings goals sooner. Visit us and find out more today! Business banking. Compare our range of business transaction and savings accounts designed to help maximise your business funds. Find out more online and get in touch today! What terms are available on ME Bank term deposits? According to ME Bank, it offers term deposits with terms (the length of time your money is deposited) typically ranging from a minimum of one month to a maximum of five years. You can use Canstar’s term deposit calculator to help you work out what term length might be suitable for you. Have a couple term deposits with them. Have an emergency situation so need to break one of the term deposits early (it's due to finish in october). You have to wait 31 days to get the money. I said it's an emergency and I will fore go the couple hundred dollars of interest.

ME Bank is owned by 26 industry superannuation funds, including AustralianSuper, UniSuper, Cbus, HESTA, and Hostplus.[1]

History[edit]

Industry Funds Services (IFS) was founded in 1994 by a group of industry super funds.[2]

Also in 1994, Super Member Home Loans (SMHL) was launched by the ACTU in partnership with National Mutual (later to become Axa). The primary focus of SMHL was on providing home loans to Australian members of industry super funds.

In 1998, SMHL achieved $1 billion in funds under management; and in 1999, IFS entered into an agreement with AXA to establish a 50/50 joint venture company. In 2000, IFS and Axa launched Members Equity Bank Limited, that offered other banking products as well as home loans. Members Equity Bank obtained an Australian banking licence in July 2001, and was approved to act as an authorised deposit-taking institution, authorised to accept deposits from the public.

In 2002, AXA withdrew from the joint venture, and Members Equity Bank became 100% owned by industry super funds.

In 2003, Members Equity Bank obtained a financial services licence and began offering financial services, in addition to bank deposit accounts. Also in 2003, the bank achieved $10 billion in funds under management.

In 2009, Members Equity Bank was re-branded to 'ME Bank', and in 2015, 'ME Bank' was shortened to 'ME'.[citation needed]

IFS continues to provide fee-for-service financial planning advice for members of industry super funds.

In 2021 ME Bank was purchased by Bank of Queensland for $1.325 billion. [3]

Retail banking services[edit]

ME Bank offers customers a range of banking products and services, including transaction and savings accounts, home and personal loans, term deposits, and credit cards.

ME Bank operates as a direct bank and has no branch network. Services and support are provided over the phone, through online banking, or by a mobile salesforce of banking managers.

Bank Term Deposit Interest Rates

References[edit]

- ^http://www.mebank.com.au/about-us/about-me/corporate-governance/#Shareholders

- ^Industry Funds Services

- ^[1]

3. https://www.smh.com.au/business/banking-and-finance/despicable-me-the-boutique-bank-raiding-accounts-linked-to-home-loans-20200501-p54oxn.html